Aeron Composite IPO is set to open on August 28, 2024, and will consequently close on August 30, 2024. This Book Built Issue aims to raise approximately ₹56.10 crores. Specifically, it includes a fresh issue of ₹56.10 crores and also features an offer for the sale of equity shares, each with a face value of ₹10.

Table of contents

- Aeron Composite IPO Overview

- Company Details

- Key Dates

- Financials (₹ in Crores)

- Objective of the Issue

- Company Promoters

- Aeron Composite IPO GMP (Grey Market Premium)

- Aeron Composite IPO Application Form PDF

- Aeron Composite IPO Subscription Status

- Aeron Composite IPO Allotment Status

- IPO Review

- Aeron Composite IPO Registrar

- Aeron Composite IPO Lead Manager

- Aeron Composite Limited Contact

- FAQs

Aeron Composite IPO Overview

| Overview Points | Description |

|---|---|

| Company Name | Aeron Composite Limited |

| Industry | Ceramic refractories |

| IPO Issue Type | Book Built Issue |

| Open Date | August 28, 2024 |

| Close Date | August 30, 2024 |

| Total Issue Size | ₹56.10 Crores(4,488,000 Equity Shares) |

| Face Value | ₹10 Per Equity Share |

| Fresh Issue | ₹56.10 Crores (4,488,000 Equity Shares) |

| Price Band | ₹121 to ₹125 Per Share |

| Listing on | NSE SME |

| Lot Size | 1000 shares |

| Offer for Sale | N/A |

| Shares Offered to Retail | 35% |

| Shares Offered to QIB | 50% |

| Shares Offered to HNI | 15% |

Company Details

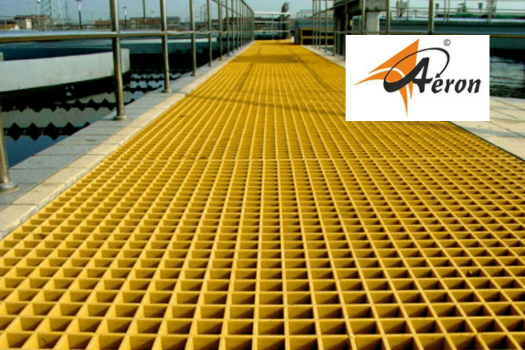

Aeron Composite Limited actively manufactures and exports FRP products for a wide range of industrial applications. Additionally, as part of the ‘A GROUP,’ which operates in industries such as ceramic refractories, ceramic tiles, paints, and lime, the company delivers high-quality advanced composite solutions that meet both national and international standards. Headquartered in Ahmedabad, Aeron Composite not only designs, tests, and manufactures prototypes but also provides logistics support, installation, and comprehensive after-sales service. Furthermore, recognized as a “Two Star Export House,” the company holds a Certificate of Recognition and has successfully served over 800 customers.

It represents a book-built issue of ₹56.10 crores. Specifically, the issue consists entirely of a fresh issue of 44.88 lakh shares. The IPO opens for subscription on August 28, 2024, and will close on August 30, 2024. Following this, the allotment for the Aeron Composite IPO is expected to finalize on Monday, September 2, 2024. Subsequently, It will list on NSE SME, with the tentative listing date set for Wednesday, September 4, 2024.

The price band for the Aeron Composite IPO ranges from ₹121 to ₹125 per share. In addition, the minimum lot size for an application is 1,000 shares. Therefore, the minimum investment amount required by retail investors is ₹125,000. For HNI investors, the minimum lot size investment is 2 lots (2,000 shares), amounting to ₹250,000.

Key Dates

| Events | Date |

|---|---|

| IPO Open Date | August 28, 2024 |

| IPO Close Date | August 30, 2024 |

| Basis of Allotment | September 2, 2024 |

| Refunds | September 3, 2024 |

| Credit to Demat Account | September 3, 2024 |

| IPO Listing Date | September 4, 2024 |

Financials (₹ in Crores)

| Period Ended | 29 Feb 2024 | 31 Mar 2023 | 31 Mar 2022 |

|---|---|---|---|

| Assets | ₹99.79 | ₹69.10 | ₹60.63 |

| Revenue | ₹180.80 | ₹181.99 | ₹109.92 |

| Profit After Tax | ₹9.42 | ₹6.61 | ₹3.62 |

| Net Worth | ₹34.78 | ₹25.35 | ₹15.57 |

| Reserves and Surplus | ₹33.21 | ₹23.79 | ₹14.27 |

| Total Borrowing | ₹12.08 | ₹13.99 | ₹12.55 |

Objective of the Issue

- Funding the capital expenditure requirements for setting up an additional manufacturing unit.

- Along with addressing general corporate purposes.

Company Promoters

- Dilipkumar Ratilal Patel

- Chirag Chandulal Patel

- Pankaj Shantilal Dadhaniya

- Ravi Pankajkumar Patel

- A. International Private Limited

Aeron Composite IPO GMP (Grey Market Premium)

Curious about the latest Grey Market Premium (GMP) for the Aeron Composite IPO? Look no further! Visit our dedicated IPO GMP section where we keep you in the loop with daily updates on all IPOs, including Aeron Composite Limited. Additionally, stay ahead of the game with real-time GMP insights that can help you make informed investment decisions. Whether you’re a seasoned investor or just getting started, our updates have got you covered!

Aeron Composite IPO Application Form PDF

To download the Aeron Composite IPO application form, simply check out the IPO Forms. Additionally, you can download the ASBA IPO Forms PDF.

Aeron Composite IPO Subscription Status

This IPO subscription kicks off on August 28, 2024! Meanwhile, if you’re looking to stay updated with the latest subscription figures, head over to our IPO Subscription section for real-time data on all ongoing IPOs. Moreover, don’t miss out on the action—track the progress as it happens!

Aeron Composite IPO Allotment Status

To check the Aeron Composite IPO allotment status go to the IPO registrar website Maashitla or go to IPO Allotment.

To check allotment status. Firstly, follow the steps below:

- Firstly, go to the link given above.

- Secondly, select the company name.

- Then, enter your PAN Number, Beneficiary Number, Application Number, or CAF Number.

- Finally, submit the details to get the allotment status.

IPO Review

Strengths:

- Established Market Presence: Aeron Composite leads as a manufacturer and exporter of FRP products. Consequently, the company demonstrates strong industry experience and expertise.

- High-Quality Solutions: Furthermore, the company offers advanced composite solutions that meet national and international standards, which ensures both reliability and competitiveness.

- Comprehensive Services: Additionally, Aeron Composite provides end-to-end solutions, including design, testing, installation, and after-sales service, enhancing customer satisfaction.

- Recognition and Experience: Furthermore, Aeron Composite holds a “Two Star Export House” status and has served over 800 customers, reflecting its credibility and market reach.

Risks:

- Capital Expenditure: However, the company might strain its financial resources and impact short-term profitability due to the significant investment required for setting up an additional manufacturing unit.

- Market Dependence: Additionally, heavy reliance on specific geographical regions or industries could expose the company to localized economic downturns or market fluctuations.

- Intense Competition: Furthermore, the company faces challenges from well-established competitors due to the highly competitive nature of the technology and services sector.

Aeron Composite IPO Registrar

Maashitla Securities Private Limited

Phone: +91-11-45121795-96

Email: ipo@maashitla.com

Website: https://maashitla.com/allotment-status/public-issues

Aeron Composite IPO Lead Manager

Hem Securities Limited

203, Jaipur Tower M.I. Road, Jaipur – 30200

Phone: +91 141 4051000

Email: support@hemsecurities.com

Website: https://www.hemsecurities.com/

Aeron Composite Limited Contact

Aeron Composite Limited

Saket Ind. Estate, Plot No. 30/31,

Sarkhej Bavla Highway, Village Moraiya,

Changodar, Ahmedabad – 382213

Phone: +91 9909988266

Email: cs@aeroncomposite.com

Website: https://www.aeroncomposite.com/

FAQs

It opens on August 28, 2024, for QIB, NII, and Retail Investors. It will close on August 30, 2024.

The investor allocation is divided as follows: QIB receives 50%, NII receives 15%, and Retail Investors receives 35%.

You can apply for an IPO online via ASBA through your bank account. You can also apply using UPI through your stock broker’s platform or submit an offline application with your stock broker.

Additionally, It raises ₹56.10 crores.

It has a price band between ₹121 and ₹125 per equity share.

For the latest news on Upcoming IPOs and IPO GMP, follow IPOGMP.IN. Additionally, connect with us on Twitter, Facebook, and Instagram.